Should You Lease A 2015 Toyota Tundra?

Tim Esterdahl | Mar 30, 2015 | Comments 19

One of the least understood options when purchasing a new car is leasing. A large portion of the population sees leasing as simply “renting a car” and therefore a bad deal. Yet truck leasing is on the rise, and there are some good reasons for this surge in popularity. Here’s what you need to know.

Does leasing a 2015 Toyota Tundra make any sense? Sure.

What Is Leasing?

In general terms, leasing is a different way to purchase a vehicle. In a way, it is “renting” a vehicle since you will have to make a decision at the end of your lease term. The decision will be to do one of the following:

- Give the vehicle back to the leasing company, at which point you’re responsible for it’s condition and mileage.

- Buy the vehicle at the end of the lease term for a pre-determined price.

- Trade the vehicle in (essentially buying and immediately reselling the vehicle).

- Sell the vehicle on the open market, then using the proceeds to buy out the lease.

The confusion around leasing seems to stem from the fact that there are mileage limits, condition requirements, and uncertainty about what happens at the end of the lease. As a result of this confusion (at least partially), many people think leasing is dumb.

Don’t get us wrong – there are some perfectly legitimate reasons to think leasing is a bad deal. But thinking of a lease as nothing more than a long term vehicle rental with restrictions is a mistake. While mileage limits can be an issue, and limits on modifications can be annoying, leasing does have some attractive qualities (especially in the case of the Toyota Tundra).

Why Lease?

There are four decent reasons to lease a new vehicle:

1. Driving a new (or nearly new) vehicle is very convenient. Since most lease terms last 2-3 years, your vehicle is likely completely under warranty during the term of your lease. If you’re someone who doesn’t ever want to deal with maintenance or repair issues, then a lease makes a lot of sense. New vehicles generally require zero effort beyond oil changes and tire rotations, and Toyota (along with a few other manufacturers) provides some of your scheduled maintenance free of charge for some or all of the lease term.

2. Leasing requires less cash flow and less immediate investment into a depreciating asset. Ever notice that the luxury car market is full of lease options? Here’s why: A luxury customer is much more likely to lease because they see vehicles as a depreciating asset and want to put as little cash into that asset as possible. These customers are willing to sacrifice long-term savings, in fact, as they’d rather reduce their cash flow requirements so they can put their money elsewhere.

Of course, luxury car buyers are also interested in driving a new car every few years and “looking cool” (or whatever), and luxury buyers generally aren’t frugal types who aspire to living a life where they don’t have a car payment. Their behavior may or may not be logical to you and your specific situation, but there is some logic to leasing a car simply to reduce your “nut”, freeing up income for investments.

3. Leasing gives you more options in a crisis. Unless you put a LOT of money down on a new car (25%?), you’re going to be “upside down” for the first several years of your installment loan. “Upside down” means that you can’t sell your vehicle for what you owe on it, aka negative equity.

By itself, negative equity isn’t a big deal. But if your life situation abruptly changes (like a job loss, medical issue, etc.) a lease is easier to “get out of” than a hefty installment loan (many of which are 72 or 84 months in length these days). There are marketplaces where you can swap your lease with someone else (SwapALease.com, LeaseTrader.com) for example, and depending on the terms of your lease it might even be possible to sell or trade your lease today without incurring a major charge. But the worst-case scenario is that you have to keep your lease to term. That’s 2-3 years max, and that’s a much shorter commitment than a 6 or 7 year purchase agreement.

4. There may be some tax benefits to leasing, at least if you can write off your vehicle as a business expense. Talk to your accountant about this one, but in many cases the lease deduction is more beneficial than the deduction you would qualify for if you purchased a vehicle outright.

Is It Smart To Lease A 2015 Toyota Tundra?

On this site, we commonly talk about residual and resale value along with Toyota quality. This is a frequent topic of conversation because great resale value and top-rated quality are proxies for durability and value. The best truck on the road isn’t the one with a fancy engine or clever suspension (or whatever) – it’s the truck that works as promised for years and years without issue.

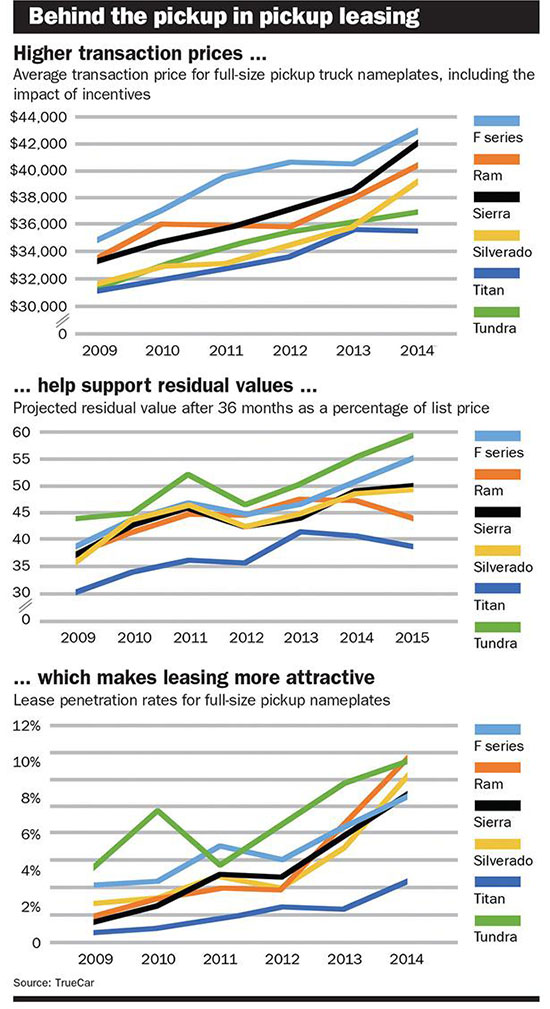

As far as leasing is concerned, top resale values lead to lower lease payments. This is because a lease is basically a purchase of a portion of a vehicle’s depreciation…the less that depreciation is, the more affordable the lease becomes. The Tundra’s residual values are best in class (it’s not even close, in fact), as you can see from the chart below. The Tundra approaches a 60% residual after 36 months, while the F-150 comes in at 5% less, while the Ram 1500 and Nissan Titan have seen their residuals decrease in recent years due to heavy incentives (chart via data from TrueCar.com).

As the chart shows, not only is the Tundra’s resale value sky-high, but the popularity of truck leasing is booming. Leasing in general is popular, but leasing a 2015 Toyota Tundra leads to a much better payment than leasing just about any of the other pickups on the market, depending on equipment and features of course.

Summing Up

The best reason to lease any vehicle is to save yourself some money today, even if it means spending more money down the road (pardon the pun). Leasing as a way of life means that you’ll always have a car payment, and that means leasing is not the most frugal choice. People who are trying to save as much money as possible over the next 10 years shouldn’t ever lease a new car – they should buy a minimally equipped vehicle and keep it until it dies.

But if you’re not as worried about saving money in the future, and you’re willing to trade some long-term savings for convenience, a lower monthly cash outlay, and perhaps a nice business deduction, leasing is a reasonable choice. And if you’re going to lease a new truck, the 2015 Tundra is worth a look. No other truck has a higher residual value.

What do you think? Have you ever considered leasing a truck?

Filed Under: Buying a Tundra

Another good reason to lease a tundra is a lower payment in general. Typically if you lease a Tundra at 36 months at the end your residual (buyout) will afford you to have about the same payments as your lease making it possible to purchase more truck……

A couple little known facts about leasing.

1. your credit looks better because your credit only shows the sum of your lease payments as what you owe for it so your debt to income looks better.

2. If your involved in a serious accident where the truck isn’t totaled your vehicle will suffer whats commonly referred to as diminished value. Under a Toyota Lease as long as the vehicle is fixed by a reputable shop you can turn the lease back in to Toyota and they assume the loss of value.

3. You only pay taxes on your payments! so you do not have to pay tax on the residual value!

All these points are correct, the best vehicles to lease r trucks… U never know what the market will do to the value of your vehicle… Remember when gas prices go up on v8 trucks values go down. This is exactly what happened in the crisis in 09 when gas went to almost $5 a gallon. Do u really wanna b stuck with a vehicle that is worth just over half of blue book?? Kbb is a guideline what dictates your vehicles worth is what a consumer will walk up and pay for it… No matter what happens to The market that effects your truck you can walk away from negative equity. Accident, gas prices newer technology. These all effect your value. Vehicles r not an investment they r a necessity. Why would u spend all the money to buy it when u know it will never worth what your paying for it. At the end of the lease if u feel u want to continue to buy it u can or just walk away from it. Much better to lease n more options. A lot of People don’t know u can buy it at anytime if u like… Would u buy a home today for 400k if u know it will be worth half in 3 years?? No so why do it with a truck… At the end of the lease if the truck is worth more than your buy out either buy it or trade it that equity is yours…. If its the other way around walk away and the manufacturer takes the loss of Value….

The most important elements in the three charts are: The Tundra is the best deal out there by a “wide margin” from a financial standpoint. And if you have tons of cash to burn and throw away then just lease a new Ford every three years; if you are one of the lucky ones and it can last that long? If not then be prepared for a double bath because you will pay a lot extra to get rid of the Ford.

Also, most people will sign up on a purchase for 72 months. That is the term that makes the most sense for your average car buyer because the payment is more affordable. Most people don’t keep a vehicle that long. The nation-wide average term to keep a vehicle is 3.5 years or something like that.

Most people the do actually pay off a vehicle after 5 or 6 years, will be ready to buy a new one right away after it is paid off. It usually goes like this, “ok Honey, the car is paid off, it is 6 years old with no warranty, and 80-120k miles. Let’s go buy a new one that is reliable that we don’t have to put money into.” So they end up with a payment anyway. It is rare for most people to pay off a vehicle and keep it and have no payment. That is my experience anyway.

A lease payment is usually going to be AT LEAST $100 less than any purchase scenario. That is $3600 not spent for the same term to drive the same places and do the same thing.

Remember that mileage only plays into a lease if you turn it in. It doesn’t matter what it is if you refinance and keep it, if you trade it or sell it yourself.

problem for business like mine, we put WAY too many miles on to lease then turn in.

If you are replacing your vehicles within 5 or so years its cheaper to lease them (if its a tundra) and buy the miles. it cost less to purchase the miles at 10 cents a mile rather than taking a trade depreciation of 25 cents a mile for all the overage of the extra miles. then you can just walk away…………. or wait no with a tundra you would still have equity……

BIG MISCONCEPTION about leasing is when someone says they drive too much. The miles cause depreciation no matter whether you lease or buy. its cheaper to purchase miles on a lease than the depreciation if you have a loan on it or own it.

You should look into that. PLUS, most of the time you can write off the lease payment for your business sake. check with your accountant I bet you’ll be surprised

These are all great comments!

-Tim

Unless your vehicle is part of a business and it’s monthly least cost can be considered an operation expense never lease.

Put the numbers in a spread sheet. Buy a new truck and calculate all the costs for 10 years of ownership. Cost plus interest, insurance, repairs, fuel, add in every cost you can think of. Do the same for 10 years of leasing. The numbers won’t even be close.

Recommendations

— If it’s not possible to buy a car/truck with cash don’t do it. Get an older one which can be paid for in full. Don’t give the bank your hard earned money for interest payments for 5 or more years. On day you will be able to start paying cash and using the payment amount to build up your net worth keeping you ahead of the game and the bankers. Pay yourself for 5 years first then buy the thing.

— Dump collision insurance as soon as the thing is down to 10,000 in value.

— Leasing is a money losing deal if you can’t deduct the amount from your income. At the end of the lease the truck goes back, you are out all the money and you have no truck and have to start all over.

“A lease payment is usually going to be AT LEAST $100 less than any purchase scenario.” Of course it’s less, you don’t own the truck and you have to give it back. Don’t make payments on anything, except maybe a house or college education. Invest first then buy, this means the bankers are paying me and I call the shorts.

— When I buy a truck my hope is I will run it for 20 years or 300,000 miles. If I make it to 300,000 miles, buying will blow the lease option out the window.

I agree completely. My Toyota turns 30 this year and it’s going strong.

there is so much wrong with what you have said here and is up to how someones life comes at them. maybe that works for you but there is nothing factual about it.

1. every truly wealthy person will tell you to NEVER buy a car, rather you always lease it. this protects you from market fluctuations, diminished value if the vehicle gets wrecked and the vehicle is under warranty so the most you would pay for is maintenance. maybe if you had vehicle you were lucky enough to NEVER have a part replaced on it maybe your math gets closer but otherwise you are missing many parts of the equation to make a factual statement. for starters if the money factor on the lease is .00050 which is roughly 1.2% interest and on a loan the rate is 2.5 for 72 months then your numbers are WAY WAY off. then depending on the residual value will then change the LTV (loan to value) at the end of the lease for the buyout effectively changing the rates you can get at the buyout if you should choose to keep the truck or replace it. you NEVER have to give a lease back your ALWAYS in control whether you have a loan or lease.

2.not buying a car/truck with anything other than cash comment is up for debate as well…… cars depreciate and having a lease protects you from the market as I said above so if gas goes to $5 a gallon and your trucks value plummets because of it your NOT on the hook with all the negative equity OR if you own it your value doesn’t fall through the floor no different than your stocks losing value.

3. dump collision when the value gets under 10k? where in the world do you get that from? most of your insurance comes from liability coverage and the collision coverage costs a mere 25-50 bucks every six months. I’m quite certain i’ll pay that little money to recoup 5-10 grand if I hit black ice and hit a pole otherwise you just threw away that 5-10k……

4. a TRUE cost of ownership would take all of this into consideration as well as the cost of major repairs as you go above the 100k and 150k and 200k mile marks.

I don’t want to pick at you but this is my livelihood and I don’t believe you understand a lease well enough to make your claims or you wouldn’t say what you have. i’ll explain points further if you have questions about what I have said. there are times a purchase makes more sense to someone but generally leasing is actually a better safer way to spend your money.

Show us the numbers. If you can right off the lease, not paying any tax on the face value of the lease, it can work. I you have to pay tax on the lease it won’t.

Buying cars/truck is a loosing game now matter how you look at it. The only way to minimize how much you lose it to drive them until the doors fall off and you can’t get them to pass inspection any longer. The cost per mile goes down with every mile that goes by. Divide the purchase price by the miles consumed and it shows up.

I drove my 4WD T100 for 18 years and I paid 17,000 for it and only had to do about 3000 in repairs in all that time. That was the second best vehicle I ever owned. The best was a 1994 Subaru which went over 350,000 miles.

I am at border line of what some would consider wealthy and I will tell you right now leasing does not pay. Those truly wealthy people you mention are smart and would only lease if it’s inside a business. They wouldn’t lease on a personal purchase.

Those who only run their vehicles 5 years and then get a new one,,,, 5 new trucks in 25 years,,,, they are getting killed when you compare that to what I have spent on 2 trucks in 30 years.

For those who love new trucks every 3 – 5 years, that’s fine just don’t try and kid yourself that it’s a sound financial move purchased or leased.

One scenario. I’m not going through dozens as I don’t have the time to do it. so personal vehicle is a 2010 Tundra Crew Max Platinum MSRP 49737. at the time we had some great deals! 44,750 was the sale price with 1500 in subvention cash. so my gross cap cost with 500 down was 45,301.90 all in. I paid 562 a month for that lease with a money factor of .00005 which is .12 percent interest. at the end I purchased the truck for a measly 23,892 plus tax equaling 25444.98. I write off the lease payment for the first 3 years as a business expense and then purchase at the end of the lease. ( I could have added miles to make the payment bigger) now at the end of the lease the truck which I purchased for 23,892 was worth 33,500 trade at that time or if I wanted a new truck I could put a little money down to get the same payment to write off again and take 9000 and pocket it. either way I paid 20232 over 3 years and had 10,000 in positive equity at the end of lease making my investment 10232 for 3 years but I wrote off 20232 in payments. if you are following me with the tax savings I paid myself to have the truck. this scenario doesn’t work with other manufacturers as they lose their value too fast. I currently today have a payoff of 15,200 and the trade in is worth 30k or I could sell private party for 34k. the difference In what I pay to have a vehicle that is under warranty is very very little. in the end it all depends on your household needs but their are VERY smart ways to do this without wasting money as you suggest.

I have to say Hemi, you are a sales guy at heart, LOL. You have me at least raising an eyebrow. It would be nice to have an honest sales guy run through the numbers for me next time I purchase. I need about 25K miles a year and like new trucks every three years. Trucks are titled in the business. I have about 10-12K of equity I have been rolling from truck to truck for down payments so I don’t come out of pocket at the time and can drive the trucks I want (loaded) for about 500-525 a month.

first toyota needs to add a few things to the tundra for me… 🙂

Breathing Borla, reach out to me on tundratalk when you do. I’ll be happy to lend a hand. You probably aren’t close enough to do business with and I still wont mind running you through some scenarios to help a brotha out.

I can see a lease making sense to the person who updates their rig every few years, and thus will always have a payment of some sort.

For me, it makes no sense. When I buy anything with a motor, I get my money’s worth. My daily driver is my 1985 Toyota pickup that I bought as a repo in 1987.

My other vehicle is a 1990 4runner that I purchased new in 1990. I paid cash for both.

I sacrifice not having the latest and greatest vehicle in return for never having a car payment in my life. Not bad for 52 years on the planet.

It’s amazing how much money that frees up for other things in life.

A 1985 pickup and a 1990 4Runner. Gook luck killing those 2. You will be driving those for another 25 years. I have a friend who works for a wilderness organization here in Utah. He put thousands and thousands of miles on his 1990 4Runner in backcountry desert locations doing field reserch. After almost 20 years and the worst abuse imaginable he broke the rear differential housing. If that thing only saw pavement it would probably have lasted 100 years. He replace it with a 1993 and is not trying to kill that one.

for a mind boggling one I have a parts truck that is a 2001 Tundra reg. cab. with the 3400 V6 with 623,000 miles on it. piston rings at 500,000k and timing belts and water pumps every 90k. one set of exhaust and tires and brakes. still in use every day.

I have over the past 20 years always retail financed and saved up enough money after a few years of financing to then just keep trading in my newer (2-3 year old vehicles) for a decent trade in price and paying ‘cash’ deal between trade in and new purchase price, especially back in 90’s chevy silverado’s until 2007 got my tundra.

I maybe extreme case doing this for 20 years now, but say I spent 32K on my 2014 tundra, trade it in for 27K 2 1/2 to near 3 years from now, so out 5K in cash on new vehicle or maybe 6K then. You lease a new tundra for say 400 per month x 24 months = OVER 9000 dollars out vs. just 6K out for retailing it or in my case now just paying cash difference every few years being 5-6K usually. 5-6K paying in cash is better than 9K+ for leasing in 24 months or so. It just takes a few of the first few years to retail finance and keep saving up money until you have enough money to cough up the dough on a new vehicle. It works, just have to be frugal with your extra income saving it until you have enough dough to spend on a new vehicle. I don’t buy junk vehicles and the tundra and toyota in general normally has much higher trade in values.

Plus, only 12K miles per year on a lease is hard to keep that miles on it for me, but can be done if watching where you drive and don’t drive if not needing to. I like the freedom to go when I want and where I want but usually is at 12K or a tad more per year now.

yet again, I may not be the norm, but I started doing this in the 1990’s when chevy silverado’s in my area were HOT sellers (GM plant nearby) and well over 50% within a 100 mile radius were chevy silverado’s for 1/2 ton trucks. I retail financed a few new silverado’s and then kept trading them in every 6-10 months year after year after year. It helped A TON getting the GMS discount (employee pricing) which was at the time about 18% off full msrp or about 2 grand or so under dealer invoice pricing. A few times, believe it or not, only after 6-9 months owning the silverado and about 12K miles or so on truck at most, I had the GM dealer give me money BACK on trade in vs. buying new yet again next model year newer which hit the timing just right offering tons of rebates way back then and the silverado’s were selling well, unlike in today’s world, especially since the GM plant nearby closed in 2008.

No one can argue though on here the tundra has the highest resale/trade in value of the Big 3 and right now, is one of the cheapest comparing apples to apples of the Big 3 1/2 ton trucks as well for purchasing. Biggest problem is around me the people have been drinking the ‘kool-aid’ way too long and old school thinking always buying GM or Ford around me anyways and refuse to change as market conditions change. I did chane in 2007 when I bought my first 2007 tundra having bought probably pushing 15+ new chevy silverado’s since around 1991 or so. GM was going down the tubes locally with plant closing nearby and bankruptcy as well, good time to leave them adn haven’t been back since. Right now, the new GM trucks are too expensive for me not offering the value nor resale as the tundra does now.